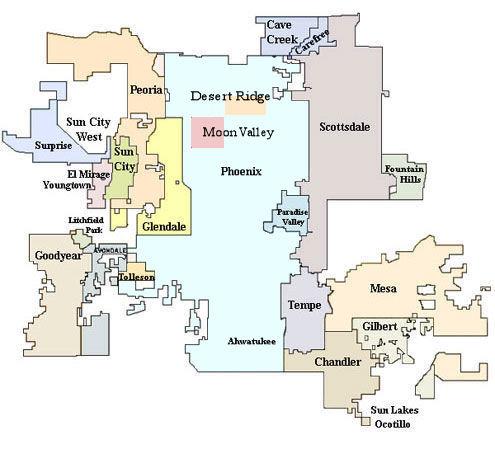

Information Regarding Maricopa County Including the Metropolian Area of Greater Phoenix, Arizona

ABOUT METRO PHOENIX

Although many people refer to the entire Greater Phoenix area as simply "Phoenix," the City of Phoenix is the nexus of everything. One of the fastest growing cities in America, Phoenix recently achieved the status of the 5th largest in the country. Greater Phoenix includes approximately 23 cities and towns. Families represent 66 percent of the Phoenix population, with the median annual income running about $47,200. Almost 23 percent of the Phoenix population have at least one college degree.

High tech, aerospace, and service industries comprise the majority of industry in Phoenix. Major employers include Banner Health, Honeywell, Wells Fargo, and Target.

Phoenix is home to a number of higher education institutions, including Arizona State University Downtown, Phoenix Community College, Ottawa University, DeVry University, Grand Canyon University, Apollo College, Western International University, and others.

As you can imagine, there are numerour attractions, sites, and activities to see and do in Phoenix. Some favorite attractions include the Arizona Science Center, Heard Museum, Desert Botanical Garden, Chase Field (home to the World Series champion Arizona Diamondbacks), Phoenix Zoo, Phoenix Art Museum, Wrigley Mansion, and the Phoenix Symphony.

As of August, 2009, the median price of a single-family home in Phoenix is $163,900 and there are currently more than 9,000 properties on the market.

Please click the links below for further information

on any of the various areas within Greater Phoenix.

_______________

Desert Ridge is a master planned community bordering North Phoenix and North . It is located south of Pinnacle Peak Road between Road and Cave Creek Road. Construction on the 5,700-acre community began in the late 1990s. Its communities include Desert Ridge Aviano and Fireside at Desert Ridge. The current Desert Ridge population is just over 6,000. Single-family homes in Desert Ridge start as low as $235,000; higher-end homes go for close to $1 million.

_______________

Fountain Hills, a planned community of more than 19,000 residents, sits tucked into the foothills between and Mesa. Founded in 1970, the tiny town is bordered to the north by McDowell Mountain Park, to the south by the Salt River Indian Reservation, to the east by the Ft. McDowell Indian Reservation, and to the west by the McDowell Mountains. Homes in Fountain Hills begin around $150,000 and range upwards of $2 million. The average estimated value of a home in Fountain Hills was $312,052 in March 2009.

_______________

With a population of nearly 250,000, Phoenix is Arizona's fourth largest city. This friendly community has a small-town feeling, the charm and character of its past as important as its growth and progress toward the future. Most Phoenix residents are young, college-educated, married with children, and an average annual income of more than $53,000. Phoenix homes run the gamut from newer, luxury estate homes to older houses, cozy bungalows, charming townhomes, planned communities, and many houses affordable to the first-time buyer. Prices start at about $80,000 and head northward of $3 million.

_______________

Located in north Phoenix, Moon Valley is a small planned community that offers close access to the amenities of the metro area, while maintaining a quiet refuge away from the hustle and bustle of the big city. Moon Valley is bordered to the north by Bell Road, to the south by the Phoenix Mountain Preserve, to the east by Cave Creek Road, and to the west by 19th Avenue. The Moon Valley Country Club offers a full range of family activities, in addition to a championship 18-hole golf course. Home prices in Moon Valley start at about $200,000 and range all the way to $3 million+.

_______________

Northeast Phoenix, a family-friendly suburban area of the city, adjoins , Carefree and Cave Creek to the east, Anthem to the north, and Paradise Valley to the south. The Northeast Phoenix real estate market is diverse. Home prices range from around $85,000 to better than $2 million. Whether you're looking for a cozy condo, a modest single-family home, a winding estate, or something in between, you're sure to find the perfect home in this beautiful community.

_______________

Northwest Phoenix is a suburban residential area that generally refers to the North Mountain, Deer Valley, Desert View, and Happy Valley areas. The median sale price for homes in Northwest Phoenix is $159,900. The estimated median household income for 2007 was $82,600.

_______________

With a population of about 15,000 and covering a geographic area of 16.5 square miles, the town of Paradise Valley is zoned for one-acre lots with one house per lot. It showcases breathtaking views of the scenic Mummy and Camelback mountains. With one of the most exclusive zip codes in the entire country, Paradise Valley is home to twelve resorts and some of the best golf courses in the Valley. The median home price in Paradise Valley is $1.74 million, most of which are custom or semi-custom homes.

_______________

Founded in the 1880s, Phoenix is a suburban community located about 11 miles from Central Phoenix, named for after the hometown of families from Phoenix, Illinois, who moved to the area to work the fertile land created by the Arizona Canal. One of its best-known attributes is the Phoenix Sports Complex, Cactus League Spring Training home to the San Diego Padres and Seattle Mariners. Today, the city is home to some 85,000 residents and covers about 117 square miles northwest of Phoenix. As of March 2009, the median sales price for a home in Phoenix was $174,000.

_______________

, the "West's Most Western Town," has a population of about 236,000 and more than 300 days of sunshine each year. is loosely divided into several areas: South , Old Town , Civic Center/Fashion Square, Shea Corridor, and North . With a median age is 39, 's resort lifestyle permeates beyond the world-famous hotels, as many of 's housing developments feature first-rate golf courses, spas, recreational complexes, and the finest shopping anywhere. As of April 2009, the median home price in is $772,000. The city's architecture generally combines Mediterranean and Southwestern styles.

_______________

Phoenix is the largest master-planned retirement community in the world, with a population of 45,000. Friends and neighbors, the arts, physical fitness, and golf are key components of the active-adult lifestyle. As a retirement community, Phoenix is age-restricted: one member of the household must be 55 or older, and no one under the age of 18 is permitted to live there. Phoenix real estate options include single-family detached homes, condominiums, townhouses, and land lots. As of March 2009, the average price for a home in Phoenix was $131,000.

_______________

With a population of about 91,000, Surprise is bordered by one of Arizona's largest mountain preserves, and is situated in the stunning desert, adorned with mighty saguaros. Brimming with small-town friendliness, this quaint city is perhaps best known as the Spring Training home of the Kansas City Royals and the Texas Rangers. As of April, the median sale price for a home in Surprise is $190,000.

_______________

Arizona's sixth-largest city, with more than 176,000 residents, Tempe successfully blends the dynamic environment of a high-tech business center, the fun and excitement of a resort community, the warmth of a comfortable neighborhood, and the quaint appeal of a small-town college community. Tempe is home to Arizona State University, one of the three largest universities in the country, with an enrollment of 67,000 students. Many housing developments are centered around Tempe's extensive network of parks. The median income in Tempe is $47,700. As of April 2009, the median home price in Tempe is $249,900.

LINKS TO GREATER PHOENIX & ARIZONA CHAMBERS

http://arizona.uscity.net/Chambers_of_Commerce/

http://www.2chambers.com/arizona2.htm

http://www.cirs.org/arizona-gov-chambers.html

Click on any of the links or pictures below

for more information about Phoenix and Arizona!

________________________________________________________________________________________________

It's a fact of life these days ... due to the shaky American economy and the collapse of the housing industry, more and more homeowners are falling into foreclosure.

It's a fact of life these days ... due to the shaky American economy and the collapse of the housing industry, more and more homeowners are falling into foreclosure.

As with all things, there are two sides to this situation:

- If you're a homeowner who is behind on your payments, falling into trouble, or finding yourself facing foreclosure, please call us now at 623-340-0934-595-8900. We may be able to help you find a way to stay in your home, or come up with a better solution to the problem than you can see. Sometimes, when we'r too close to a problem, everything looks darker than it really is. I'll be honest, we've helped a number of people in this situation, but we can't save everyone from foreclosure. You won't know, though, if you don't call us to find out. You keep hearing it - and I'm going to say it again - if you're in trouble with your mortgage, the worst thing you can possibly do is nothing.

- The high number of foreclosures in the Valley and around Arizona are making this red-hot buyers' market. So if you're looking to make the move up to owning your first home, this is definitely the time to do it. Learn how to make buying your first home EASY!

If you (or someone you know) are facing foreclosure, the following organizations may be able to offer consumer foreclosure assistance:

Arizona Foreclosure Help-Line

Hope Now

Neighbor Works America

Homeownership Preservation Foundation

My Money Management

Law Help

For more in-depth information, please visit the Arizona Association of Realtors' Web site. They've got great information on legal foreclosures and liens; a legal hotline Q&A; bank-owned business risks & rewards; and "The Mechanics of the New Commercial Real Estate Broker Lien Law."

I've been asked a lot of question lately about the difference between purchasing bank-owned properties vs. short-sale properties. The term "bank-owned" (also known as REO or Real-Estate Owned) refers to homes that have gone back to the bank after an unsuccessful foreclosure auction. Short sales are still owned by the seller, but they owe more on their homes than they are worth in the current market.

If I were the buyer, I would much prefer to make an offer on a bank-owned home vs. a short-sale home. Why? When you make an offer on a bank-owned property, once they bank agrees to the terms and conditions, you can move forward to the closing knowing that the transaction is approved.

With a short sale, there sometimes is no "real" answer about approval until the bank and the seller come to an agreement - and many times, and in my  experience, that seems to be happening more and more often, especially in the last six months or so. This means you could be just about at your anticipated closing date and lose the home because the bank and seller couldn't come to a final arrangement of financial terms.

experience, that seems to be happening more and more often, especially in the last six months or so. This means you could be just about at your anticipated closing date and lose the home because the bank and seller couldn't come to a final arrangement of financial terms.

If you're an investor or you're buying the house as a second home, that isn't such a big deal. But if you intend to move into the home, having the transaction fall apart at the last minute puts you at a serious disadvantage. Think about it ... your lease is up and your moving truck is loaded. You get the picture, and it's not pretty, for this surely would create a very stressful situation for a family. You'd have to make quick choices about where to live, and start looking for another home to purchase.

Both bank-owned homes and short sales will give you the opportunity to do a home inspection, upon which the sale is contingent. Bank-owned properties are sold in "AS IS" condition, so expect that they will make absolutely NO repairs. Also, since the seller (the bank) has never lived in the home, they have no real knowledge of what may or may not be a problem situation with the property. It's the old "buyer beware" situation. This isn't to say there aren't some great deals to be bought in the Phoenix market ... there certainly are some great buys! Just be certain to hire an ASHI-certified home inspector and find out up front what your added expenses will likely be after you close on the home. In this circumstance, no surprises is a good thing.

With many short-sale properties, the seller has no money to do any repairs, so it puts the potential cost of repairs on the buyers' shoulders. On the positive side, the seller often has lived in the home or is still living there, and has full knowledge of the home's condition. The seller can tell you if the AC has been replaced or if there've been any plumbing problems, roof issues, etc. ALWAYS have a home inspection should buy a short sale property.

In our office, we have seen a number of bank-owned properties be bid up over list price. The banks price them low, hoping to bid the sales price up. Once the word gets out to agents about an REO, they flock to the "good deals," hoping they can help their clients win the bidding war.